Tariffs are usually the stuff of customs codes and shipping manifests. Yet in the second week of October 2025, a policy swing in Washington ricocheted across the most digital corner of finance. After President Donald Trump announced new 100% tariffs on Chinese goods alongside fresh restrictions on critical software connected to China, risk assets shuddered. Bitcoin slid into a fast drawdown, major altcoins cratered, and leveraged traders faced sweeping liquidations. The sell-off didn’t stop at crypto; mega-cap tech shares also tumbled as investors tried to price a more profound and more prolonged U.S.–China economic confrontation.

Within hours of the announcement on October 10, Bitcoin fell more than 8% intraday, dipping below $110,000 at the lows before a partial recovery. Analysts linked the move to the tariff shock, the explicit mention of software-related controls, and the familiar risk-off chain reaction that drives correlations between crypto and equities during macro stress. Over the weekend and into Monday, prices rebounded but remained well below the week’s highs, underscoring the fragility of sentiment.

This article examines what Trump’s China software tariffs entail, why they hit crypto markets so quickly, how on-chain data and market microstructure amplified the move, and what this evolving policy front could mean for digital assets through year-end. We’ll also explore strategy considerations for traders and long-term investors navigating a regime where geopolitics, export controls, and tariff schedules increasingly steer crypto’s cycles.

What exactly changed: The new tariff and software restrictions

On October 10, 2025, the White House escalated its trade stance by announcing an additional 100% tariff on imports from China, with policymakers and administration statements pointing to tighter restrictions on “all critical software” associated with Chinese entities. Officials framed the step as a response to Beijing’s own curbs—particularly around rare-earth exports—and national-security concerns tied to technology supply chains. Markets were already on edge, but the scope and headline number snapped attention and triggered immediate repricing.

Several elements matter for crypto:

-

Software specificity. Beyond generic goods, the rhetoric singled out critical software, raising questions about software libraries, developer tools, cloud services, middleware, and firmware dependencies inside the broader tech stack. If compliance regimes tighten around these dependencies, U.S. exchanges, miners, staking providers, and Web3 infrastructure teams could face vendor risk and licensing headaches.

-

Timing and uncertainty. Tariffs and export controls often roll out with phase-ins, exemptions, or subsequent clarifications. But markets discount first, ask questions later. The uncertainty premium widened, with risk assets repriced on the possibility of supply chain disruption, reduced capital flows, and a higher path for volatility.

-

Global spillovers. The U.S. action hit global tech sentiment, including cloud, semiconductor, and platform companies. Mega-cap tech lost hundreds of billions in value, reinforcing cross-asset risk aversion that tends to bleed into crypto beta.

Why did crypto react so violently

Correlations and the risk-off reflex

Even though Bitcoin is often described as digital gold and a hedge against fiat debasement, it trades like a high-beta macro asset during acute policy shocks. In 2025’s liquidity regime, correlations between BTC and growth equities can spike on headlines that threaten earnings visibility, global trade volumes, or access to critical inputs—exactly what tariff escalation signals. The result was a synchronized sell-off: stocks slid, and crypto markets cascaded lower, with Bitcoin dropping more than 10% from the week’s highs while Ethereum, Solana, and XRP registered deeper percentage losses. Liquidations surged to multi-billion-dollar totals, according to multiple market trackers.

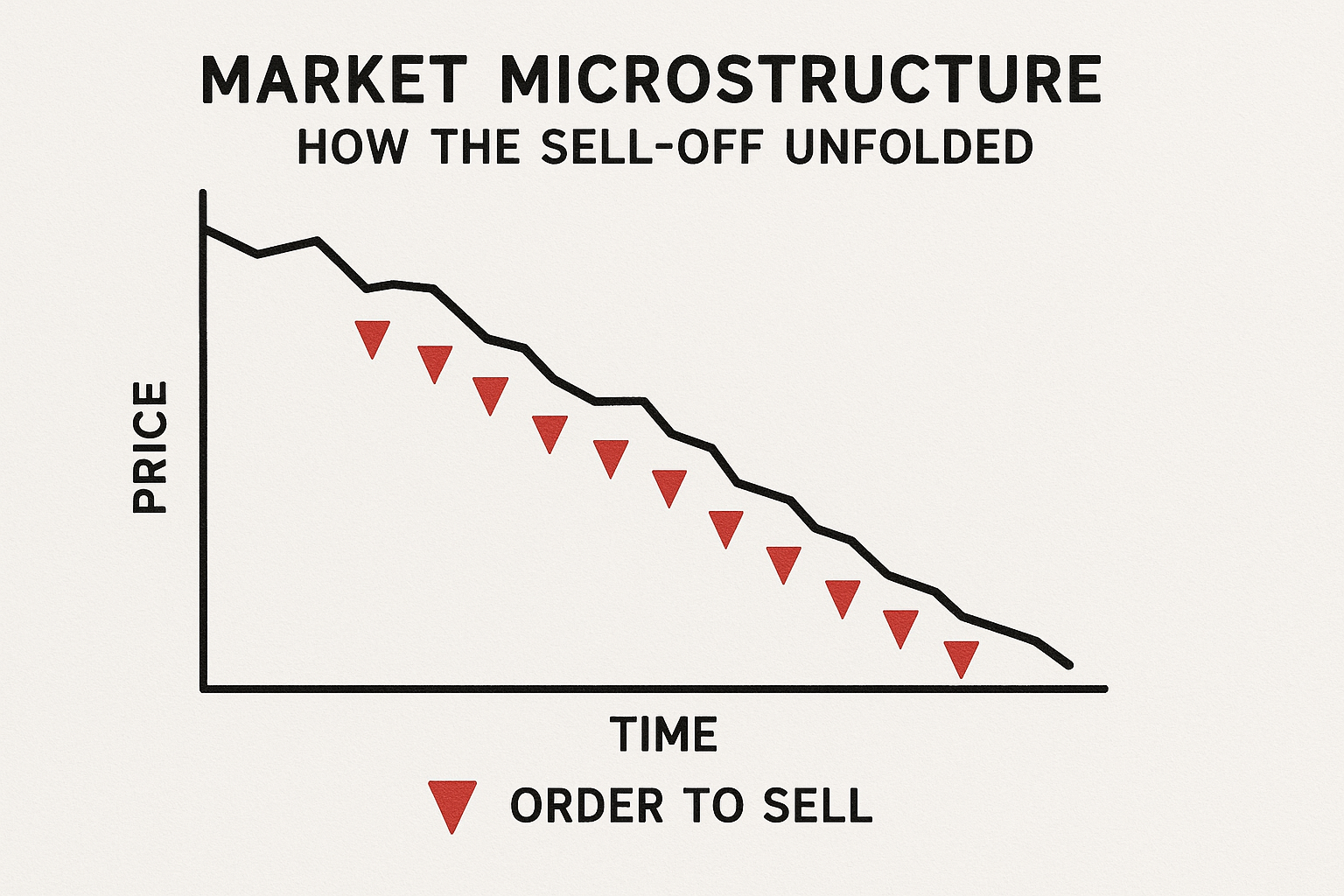

Leverage, liquidations, and “air pockets”

Crypto derivatives amplify every narrative. Funding rates and open interest had climbed following fresh all-time highs earlier in the month, setting the stage for a long squeeze. Once spot and perp prices began to slide, cascading liquidations accelerated the move, triggering what some outlets described as record or near-record notional wipeouts for leveraged traders. When liquidations fire in rapid sequence, market depth thins and slippage worsens, producing the “air pocket” drops that look disproportionate to the initial headline.

The software angle: real frictions, real expenses

The emphasis on software tariffs and export controls introduces nontrivial frictions. Crypto businesses rely on vast stacks of development tools, chip drivers, firmware updates, analytics suites, and cloud-based services. Even if many of these tools are not directly in scope, the compliance burden—auditing supply chains, re-papering contracts, and swapping out components—raises costs and uncertainty. Miners and validators, whose margins were already pressured by rising energy costs and hardware arms races, may face delays and added expenses if firmware, control boards, or management software require re-sourcing. While these second-order effects take time to quantify, markets priced them in immediately.

What the data showed over the weekend

A bruising Friday, a tentative Monday rebound

The tape was dramatic. On Friday, Bitcoin knifed below $110,000, with ETH and SOL posting steeper percentage drops. Over the weekend, sentiment oscillated as traders digested the policy details and scanned for exemptions or rollbacks. By Monday Asia morning and into U.S. premarket, crypto bounced—Bitcoin retraced a chunk of losses, and large-cap alts surged mid-single to high-single digits—yet remained well below weekly peaks. The rebound came alongside somewhat softer rhetoric in public posts, calming the most extreme scenarios. Still, the volatility regime remained elevated.

Cross-asset confirmation: tech and semis in the blast radius

The tariff shock didn’t spare big tech and semiconductor names, which collectively shed an estimated $770 billion in market cap in the immediate aftermath—an unusual one-day drawdown outside of earnings season. That cross-asset weakness reinforced the view that this was a macro shock, not merely a crypto-specific story. When cloud, AI, and hardware proxies wobble together, crypto’s beta tends to spike, and liquidity providers widen spreads.

Parsing the policy: tariffs, export controls, and “critical software”

Tariffs on goods vs. controls on code

Tariffs on physical goods are straightforward to tax and enforce at ports of entry. Software, by contrast, is borderless. That’s why the accompanying emphasis on export controls matters: it extends the policy regime beyond customs lanes into licensing and compliance for code, services, and IP flows. Reuters reporting noted new restrictions specific to critical software in tandem with the headline tariff rate. If implemented broadly, such controls could touch cloud orchestration tools, embedded firmware, encryption libraries, or AI frameworks, depending on definitions and carve-outs. The technical line-drawing—and the potential for fast-evolving guidance—keeps risk premia sticky.

Downstream effects for crypto infrastructure

Crypto infrastructure straddles multiple layers: mining rigs, node software, RPC providers, custody tech, KYC/AML compliance tools, and exchange risk engines. Supply chains for mining equipment—hashboards, control chips, and power distribution—already run through Asia. If firmware updates or management software are swept into a tighter export-control regime, miners may need to pursue alternative vendors or accept performance degradation. For exchanges and wallet providers, any dependencies on Chinese-linked analytics or security tooling would warrant immediate review and, if necessary, substitution to mitigate compliance risk. These are operational headaches that markets pre-emptively discount.

Market microstructure: how the sell-off unfolded

Spot–perpetual dynamics and basis whiplash

In the first hour after the headline crossed, perpetual futures led spot to the downside as market makers pulled back, widening the basis. As liquidations hit, perp funding flipped negative and deepened. Basis traders, who had harvested carry during the preceding rally, were forced to rebalance or de-risk. The term structure on major venues flattened as implied volatility spiked, a classic signature of macro shock repricing.

Stablecoin flows and exchange balances

On-chain watchers flagged upticks in stablecoin minting on some networks and exchange inflows of BTC and ETH during the worst of the drawdown—signs of both forced selling and dip-buying attempts. The net effect was noisy, but the pattern fit a high-volatility environment: funds de-leveraging, market participants raising cash, and faster mean-reversion attempts by systematic buyers.

Liquidity fragmentation and L2 spillovers

The shock touched Layer-2 ecosystems as well. Liquidity on rollups tends to be thinner and more fragmented across DEXs, so the same percentage of outflows can produce larger price swings. That’s why L2 governance tokens and DeFi majors saw outsized prints compared with BTC. Volatility clusters moved across perps, spot CEX books, and then into on-chain venues in waves.

Is this different from previous tariff shocks?

The 2025 twist: software at the center

Earlier tariff episodes mainly targeted hardware and categories like EVs, solar, or steel. The 2025 twist is the explicit inclusion of software and technology IP within the escalation narrative. For crypto—a software-native industry that runs on open-source stacks, cross-border dev teams, and cloud platforms—the signal is starker. It suggests that policy risk can now reach directly into the digital substrate, not just the containers and chips around it. That perception change alone can widen risk premia and dampen risk appetite for months.

Markets remember April and August

Investors were already attuned to tariff headlines in April and August 2025, when rhetoric and policy proposals jolted the crypto and tech sectors. Those episodes created a kind of neural pathway: when tariff risk rises, crypto beta jumps, leverage unwinds, and liquidations spike. This time, the drawdown was steeper and quicker, partly because positioning was extended after fresh highs and because the software language suggested a deeper operational footprint.

What this means for miners, exchanges, and builders

Miners: firmware, spares, and financing

Miners must audit their firmware provenance, board controllers, and software dashboards to ensure nothing on the violation list slips into data centers. Spares and replacements may require re-sourcing, which could drive costs up in the near term. If credit conditions tighten due to broader tech weakness, equipment financing could become more expensive, testing marginal operators’ breakevens.

Exchanges and custodians: compliance by design

Exchanges will race to map dependencies across risk, surveillance, cold-storage, and wallet infrastructure. The playbook includes dual sourcing, accelerated third-party risk assessments, and contingency planning for cloud migrations if specific services become entangled in rules. Custodians will likely emphasize segmentation and crypto-native HSM stacks that minimize reliance on any single jurisdiction’s vendors.

Protocol teams: open-source advantage, but not immunity

Open-source codebases and globally distributed teams are advantages, yet they don’t eliminate the need for build pipelines, package registries, and CI/CD tooling. Expect more projects to harden their supply chains by pinning dependencies, mirroring registries, and formalizing SBOM (software bill of materials) practices. The long-term result could be healthier software hygiene across Web3, even if the near-term is messy.

Investor playbook: positioning for a tariff-driven volatility regime

Respect the new macro factor

In 2025, tariff headlines are a bona fide macro factor for crypto. That means traders should actively scenario-plan policy paths: tariff implementation on November 1 with broad software definitions; narrower definitions with exemptions; or a negotiated de-escalation that trims the headline rate. Each path implies different trajectories for BTC dominance, altcoin dispersion, and DeFi volumes.

Manage leverage and liquidity

If you trade perps, treat funding and open interest like weather reports. When OI rebuilds into resistance and funding leans positive after a rally, the market is primed for another squeeze on the next headline. Keep a tighter stop discipline and favor higher-liquidity pairs when macro risk is two-sided. On-chain, time entries where depth is thicker and slippage tolerable; during shock windows, DEX liquidity can vanish.

Hedge the tails

Options markets are finally deep enough that downside collars and calendar spreads can provide proper protection. Volatility sold off from the spike as the Monday rebound took hold, but event risk into early November remains. Consider hedges that span the tariff effective date window, when policy details—and counter-moves from Beijing—could reignite volatility.

Lean into quality

In every risk-off, quality differentiates. Large-cap networks with robust cash flows, clear roadmaps, and deep liquidity typically recover faster. Protocols with real fees and strong treasury management can keep shipping through drawdowns. If you allocate to DeFi, prioritize venues with audited code, diversified oracles, and sound risk engines.

Could the sell-off create long-term opportunity?

The reflexive path to resilience

Crypto has a habit of turning crises into infrastructure upgrades. The 2017 ICO birthed compliance-focused exchanges and custody services. The 2022 credit crunch professionalized risk management. A 2025 software tariff shock could catalyze supply-chain hardening for crypto tooling, more open-source replacements for proprietary components, and broader adoption of verifiable builds. If that unfolds, the industry exits stronger—even if prices chop in the interim.

Valuation reset and the “policy discount”

Post-shock, investors apply a policy discount on assets exposed to supply-chain or regulatory friction. If policy risk moderates—either via narrower definitions, phased exemptions, or a negotiated truce—that discount can unwind, supporting a gradual multiple expansion for crypto-adjacent equities and healthier risk appetite for tokens. Conversely, if restrictions broaden, expect lingering risk premia and a slower crawl back to highs.

What to watch next

Policy guidance and carve-outs

The key near-term catalyst is implementation guidance. Traders should monitor whether “critical software” definitions narrow to particular categories—say, firmware for specific industrial controllers—or remain broad. Narrow guidance would ease compliance anxiety and likely support a relief rally; expansive guidance could renew selling.

Beijing’s response

Markets will parse any counter-tariffs or licensing hurdles on U.S. technology. Moves targeting U.S. software services, cloud footprints, or developer platforms used by global teams could have second-order impacts on crypto builders far beyond mining.

Cross-asset tells

If mega-cap tech stabilizes and semiconductor names find footing, that’s an early sign the worst macro-beta shock has passed—helpful for crypto. Conversely, if tech sells off into earnings with negative guidance linked to tariff fallout, crypto’s ceiling remains lower in the near term.

A brief reality check on narratives

Crypto’s digital-gold thesis is about long arcs: monetary debasement, self-custody, and permissionless rails. That narrative didn’t die on Friday. But over cyclical windows, macro liquidity and policy shocks dominate. The lesson from this episode isn’t that the thesis failed; it’s that path-dependency matters. A tariff shock can coexist with a long-term adoption story, even if the journey includes sharp drawdowns and aggressive mean-reversions. Over multi-quarter horizons, the networks that deliver real utility will decouple again. In the meantime, the tape rules.

Conclusion

Trump’s China software tariffs didn’t just dent prices; they rewired the market’s risk function. By putting software at the center of the U.S.–China trade confrontation, the administration pulled crypto’s operating system into the policy theater. That shift will likely keep volatility elevated into the tariff effective window and force builders, miners, and exchanges to de-risk their dependencies.

For investors, the playbook is familiar but urgent: respect macro, manage leverage, hedge tails, and favor quality. If implementation narrows and rhetoric cools, crypto has room to heal; if not, expect more chop. Either way, software supply chains—and the crypto markets that rely on them—just learned they’re squarely in the line of fire.

FAQs

Q: Did tariffs really cause the crypto crash, or was it overdue?

The market was stretched after fresh highs, but the October 10 tariff shock was the catalyst that flipped positioning. Correlations with tech surged, liquidity thinned, and derivatives liquidations cascaded. In that sense, tariffs were the match tossed into a room rich with fumes.

Q: What does “critical software” mean in this context?

Officials referenced critical software and paired tariffs with export controls on software linked to China. The precise scope will depend on implementation guidance. Broad definitions could touch firmware, orchestration tools, or cloud services; narrow carve-outs would reduce operational risk.

Q: Why did significant tech fall if this is a crypto story?

It isn’t just a crypto story. The same policy shock that threatens software supply chains also clouds earnings visibility for mega-cap tech and semiconductor names. When they slump, risk appetite contracts across assets, amplifying crypto’s downside.

Q: Are we out of the woods after Monday’s rebound?

Not necessarily. While Bitcoin and large-cap alts bounced, prices remained below prior highs, and event risk persists into the tariff effective window. Volatility can re-accelerate on further policy news or counter-moves from Beijing.

Q: What practical steps should crypto businesses take now?

Audit software dependencies and firmware provenance, map third-party risk, prepare vendor alternatives, and establish SBOM processes for visibility. Exchanges and custodians should test migration runbooks and cloud redundancy before policy deadlines to minimize operational surprise.

See More: Bitcoin price sinks to $108K after Trump’s 100% tariffs