In the rapidly evolving world of crypto markets, few questions command as much attention as whether Ethereum (ETH) can achieve meteoric gains far beyond its current trading levels. With recent developments surrounding Ethereum ETFs, institutional flows, and regulatory clarity, some analysts and speculators are daring to ask: Can the Ethereum price reach $15,000 as ETF demand boosts institutional flows? This article explores that possibility, examining the drivers, challenges, and realistic scenarios for ETH to achieve such a significant milestone.

We will unpack how ETF demand, institutional adoption, supply dynamics, and technical patterns interact to influence the Ethereum price trajectory. Along the way, you’ll gain insight into the catalysts and headwinds that could make or break ETH’s climb, and whether $15,000 remains within reach—or more likely a dream.

Ethereum ETFs and Institutional Inflows

Why ETFs Matter for Ethereum’s Price

When institutional investors seek regulated exposure to cryptocurrencies, they often turn to exchange-traded funds (ETFs). ETFs serve as investment vehicles, enabling large capital allocations without the complexity of direct custody or cryptocurrency wallets. In the case of Ethereum, spot ETH ETFs are increasingly viewed as a step toward mainstream capital integration. The more inflows these ETFs attract, the stronger the upward pressure on the Ethereum price—especially since institutional hands tend to hold rather than trade actively.

Historically, the adoption of Bitcoin ETFs has fueled strong rallies because capital entering those funds has indirectly driven spot markets. Ethereum now appears to be following a similar path. The inflows into Ethereum-based ETFs reduce liquid supply on exchanges, tighten outstanding tradable ETH, and shift the ownership structure toward longer-term holders. This dynamic enhances the potential for upward momentum in ETH’s valuation.

Evidence of Institutional Demand to Date

In recent months, Ethereum ETFs have witnessed noticeable net inflows, underscoring growing institutional conviction. For instance, exchange-traded funds for ETH logged $461 million in inflows in a notable stretch, bolstering momentum. Reported that Ethereum ETFs drew $5.4 billion in net inflows in July 2025 alone, suggesting rising demand from asset managers and institutional allocators.

Moreover, some coverage highlights consistent positive ETF inflow streaks—such as 16 consecutive days, accumulating over $2.32 billion. Analysts now point to these inflow trends as a proxy for institutional sentiment and liquidity demand for ETH. That said, not all ETF flows have been smooth. Some periods saw weak or negative flows, reflecting profit-taking, rotation, or risk aversion. The key question is whether these inflows can sustain and amplify over time.

Can Ethereum Price Reach $15,000? — A Realistic Framework

Understanding the Gap to $15,000

First, it’s vital to recognize how far $15,000 lies above Ethereum’s current range (as of mid-2025). ETH has seen highs in the $4,000–$5,000 zone in recent cycles. For ETH to reach $15,000, it would require a multiple of 3 to 4 times above those peaks. That’s not an impossible jump in theory, but it would demand an extraordinary convergence of positive variables—massive inflows, sustained adoption, favorable regulation, and structural scarcity.

Supply Constraints and Ownership Distribution

A central pillar that could support aggressive ETH appreciation is a change in supply dynamics. Unlike some assets with a fixed supply, Ethereum’s supply is influenced by staking, issuance, and burns (especially after the London upgrade and EIP-1559). As more ETH is locked in staking or held by institutional-grade investors, the available supply in exchanges shrinks. That scarcity effect magnifies the price impact of further inflows.

Additionally, as ETF holdings and treasury reserves increase, ETH becomes less “float” and more locked in long-term hands. When institutions accumulate and do not trade, price volatility can decrease while upward pressure strengthens.

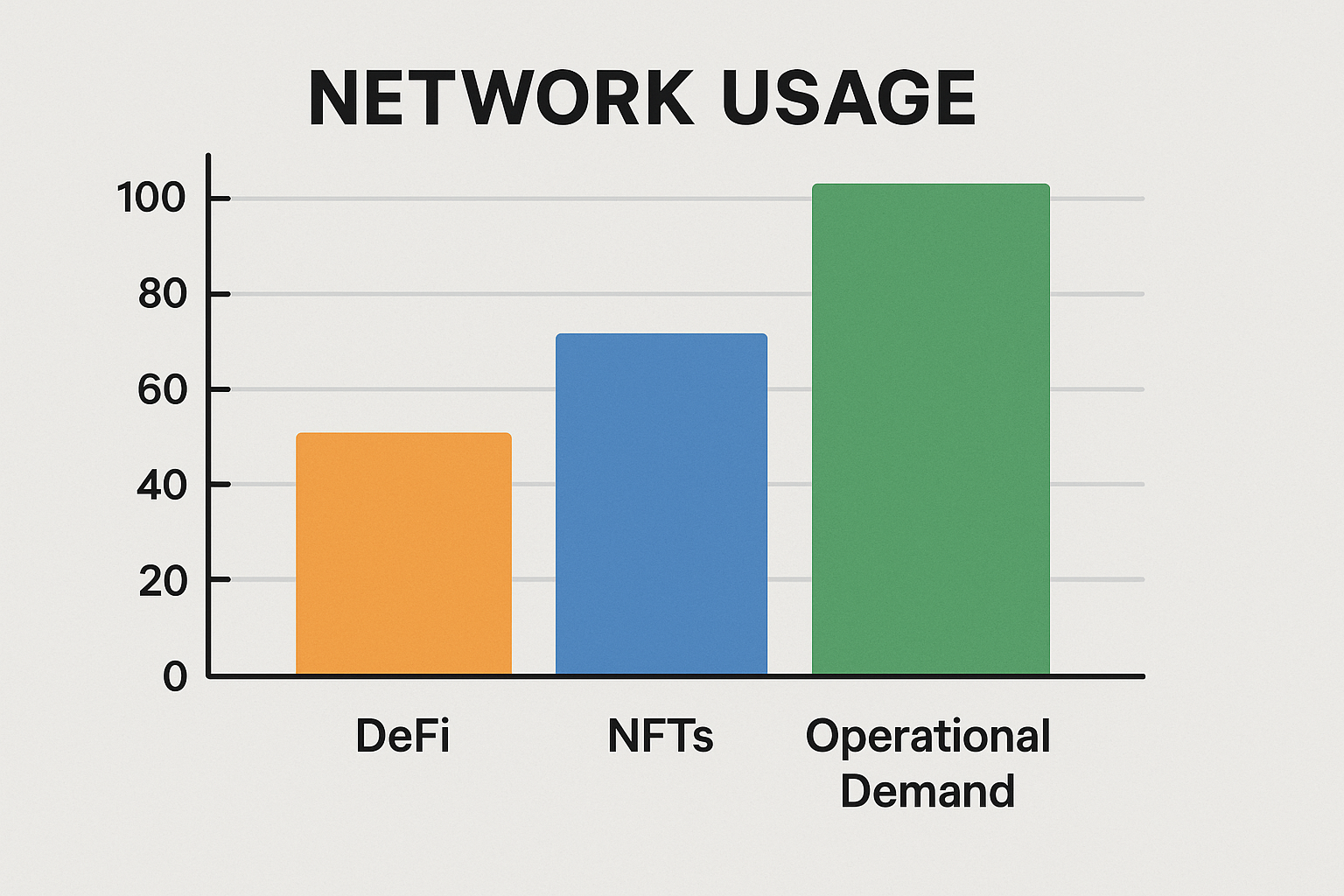

Network Usage, DeFi, NFTs, and Operational Demand

Ethereum’s core value proposition remains rooted in its broad ecosystem: decentralized finance (DeFi), smart contracts, non-fungible tokens (NFTs), layer-2 scaling, and real-world asset (RWA) tokenization. The more Ethereum is used, the greater the demand for ETH as a gas, collateral, and settlement currency.

In scenarios where DeFi expansion, on-chain activity, new applications, and tokenization adoption accelerate, ETH’s utility demand could complement investment flows. This dual demand (investment and operational) could help support more ambitious price targets, such as $15,000.

Technical Patterns and Momentum Indicators

From a technical perspective, bullish chart patterns such as bull flags, breakouts, and trend channel extensions signal potential for aggressive upswings. Some analysts have already identified a bull flag in the ETH charts, targeting $10,000. If that pattern breaks out and momentum shifts decisively, it could set the stage for higher targets. Still, the move from $10,000 to $15,000 would likely require sustained momentum, strong market breadth, and minimal macro headwinds (e.g. interest rates, inflation, regulatory risk).

Key Catalysts That Could Drive a Surge

Continued Robust ETF Inflows

If Ethereum ETFs attract sustained, multi-billion-dollar inflows over quarters or years, that capital becomes a backbone for growth. Institutions tend to ride trends, so momentum itself may attract further inflows. As ETF demand compounds, ETH’s price could amplify in a feedback loop.

Regulatory Clarity and Favorable Policies

A significant concern for crypto investments is regulatory oversight. Should regulators in the U.S. (SEC, CFTC) and other jurisdictions provide clearer support for spot ETH ETFs, staking inclusion, or permission for ETF managers to stake ETH, that could unlock more upside. Positive regulatory guidance could remove a significant barrier to institutional adoption.

Advances in Layer-2 and Scalability

Ethereum’s scaling roadmap—via rollups, sharding, and increased throughput—will significantly impact its future utility. If gas costs drop, transaction capacity increases, and developer activity flourishes, demand for ETH as a utility token could surge. That strengthens the narrative beyond just speculative demand.

Institutional Treasuries and Corporate Adoption

Just as some public companies and institutional treasuries have added Bitcoin to balance sheets, Ethereum could become part of corporate crypto allocation. If large-scale corporations or macro funds adopt ETH as a hedge or strategic asset, it would bring a fresh wave of long-duration capital seeking asymmetric upside.

Overcoming the Challenges and Risks

Macro and Market Sentiment Risk

Crypto does not exist in a vacuum. Macroeconomic factors—such as rising interest rates, inflation, recessions, or capital market shocks—can hinder the performance of risky assets, including ETH. Even if ETF flows remain strong, external headwinds could cap gains or induce corrections.

Regulatory Blowbacks or Cracks

A sudden regulatory crackdown, change in enforcement approach, or unfavorable rulings could undercut enthusiasm. For instance, restrictions on staking income, token classification disputes, or stricter compliance obligations could raise costs for ETF providers or investors.

Momentum Exhaustion and Technical Resistance

Even with bullish patterns, markets often experience pullbacks, consolidations, or false breakouts. In particular, the transition from one psychological level (e.g., $10,000 to $15,000) may encounter resistance, profit-taking, or fatigue. Without sustained buying pressure, the rally could stall.

Competition and Alternatives

Other blockchains, new consensus models, or rival ecosystems may compete for capital and developer attention. If another protocol offers better performance, lower cost, or easier adoption, Ethereum could face headwinds.

Scenario Analysis: How Likely is $15,000?

Let’s break down possible scenarios by timeframe:

Bull Case (3–5 years)

In a bullish scenario, Ethereum benefits from steady multi-billion-dollar ETF inflows, widespread adoption across DeFi and tokenization, successful scaling, and favorable regulatory environments. In this case, ETH could perhaps reach $10,000 to $15,000 over a multi-year cycle. The accumulation of institutional capital, combined with demand from network utility, might align to produce such a trajectory—but only if many favorable conditions align concurrently.

Base Case (1–3 years)

More realistically, ETH might push into the $7,000 to $10,000 range under continued ETF demand, improved usage, and favorable macroeconomic tailwinds. Many current forecasts and technical setups target that zone before more aggressive levels. Indeed, some analysts already view $10,000 as a plausible near-term target.

Bear or Moderation Case

If ETF flows falter, regulation becomes stricter, or macroeconomic pressures prevail, ETH may struggle to break through major resistance zones or even retreat into ranges below $5,000. In such a scenario, $15,000 becomes implausible in the medium term—if not impossible. Thus, $15,000 remains an ambitious, frontier target contingent on multiple tailwinds aligning.

Putting It All Together: Can Ethereum Price Reach $15,000?

Summarizing, Ethereum’s journey to $15,000 would require a transformative convergence of institutional inflows via ETFs, scarcity of liquid supply, network usage growth, technical momentum, and regulatory clarity. The current evidence—growing ETF inflows, increased institutional interest, and bullish chart signals—suggests the foundations are being built. Still, the leap from mid-range levels to $15,000 demands not just momentum, but near-ideal conditions sustained over time.

In practical terms, $15,000 should be viewed as a long-term aspirational target, not a near-term inevitability. A more probable path would see Ethereum reach $7,000 to $10,000 within a bullish cycle, before mounting challenges emerge. However, should ETF funding accelerate, regulation stay supportive, and usage expand aggressively, the possibility of $15,000 cannot be entirely dismissed.

Conclusion

The question “Can Ethereum price reach $15,000 as ETF demand lifts institutional flows?” is bold—but not purely fanciful. Strong Ethereum ETF inflows, institutional adoption, and network usage growth provide a plausible foundation for upward momentum. Yet, the journey to $15,000 is long and risky. It hinges on sustained capital inflows, favorable regulation, macro tailwinds, and continued utility growth. For now, a more realistic target, such as $7,000–$10,000, seems more achievable during a bullish cycle. But for those playing the long game, $15,000 remains a high-reward vision to watch.

FAQs

Q: What would drive ETH from $10,000 to $15,000?

To bridge the gap from $10,000 to $15,000, ETH would need continued large inflows (especially from institutional investors), compounded scarcity of circulating supply, widespread adoption of DeFi/RWA, minimal regulatory obstacles, and sustained bullish momentum without significant macroeconomic headwinds.

Q: How sensitive is the ETH price to ETF flow changes?

ETH appears to have high sensitivity to capital flows because its market cap is lower relative to Bitcoin, and when ETFs reduce tradable supply, price moves are magnified. Some analysts argue that small increases in ETF AUM can have a disproportionately large impact on the ETH price.

Q: Can negative ETF flows derail ETH’s uptrend?

Yes. If ETFs record persistent outflows, it may signal exhaustion or rotation, eroding momentum. Negative flows reduce support and can lead to corrections or consolidation phases.

Q: How long might it take to reach $15,000 (if at all)?

Reaching $15,000 might take multiple years (3–5+), depending on the pace of institutional adoption, regulatory developments, and macro conditions. It’s not likely in a single year, absent a massive paradigm shift.

Q: Should retail investors chase ETH toward $15,000?

Retail investors should exercise caution. While catching a bull trend can be lucrative, timing peaks is challenging. A balanced approach—allocating modest exposure, utilizing risk management, and staying informed about ETF and regulatory developments—is wiser than chasing ambitious targets without a solid foundation.

See More: Bitcoin Soars to $125K After $3.2B in Spot BTC Inflows