Solana’s rise from a fast newcomer to a top smart-contract blockchain has reshaped how investors think about scaling, user experience, and cost in crypto. Boasting sub-second finality, low transaction fees, and a thriving developer base, Solana has become a hub for payments, DeFi, DePIN, NFTs, and on-chain consumer apps. At the same time, its history includes network outages, evolving tokenomics, and regulatory uncertainty. This deep-dive offers a nuanced Solana price prediction for 2025–2031, blending fundamentals, adoption trends, and scenario analysis so you can frame expectations, not chase headlines.

Before we begin, remember that crypto assets are volatile and speculative. Nothing here is financial advice. Treat the following outlook as a structured framework you can stress-test with your own research and risk tolerance.

Why Solana matters now

Solana differentiated itself by prioritizing speed and user experience. Its roadmap includes a multi-client architecture with Firedancer, a high-performance validator client engineered by Jump Crypto to boost throughput and resilience. Solana ecosystem contributors have repeatedly said a full release is targeted for 2025, with interim milestones along the way; this matters because multiple independent clients reduce single-point failures and can push capacity orders of magnitude higher. As public updates indicate, the initiative aims to transform Solana into a more robust, multi-client network by proposing performance enhancements, such as removing fixed compute block limits to increase efficiency further.

Adoption is equally essential. Third-party trackers have shown periods in 2025 where Solana led public blockchains by active addresses, and ecosystem reports highlight sustained high transaction volumes alongside growing developer activity. While individual services measure activity differently, the direction is clear: Solana apps are seeing significant usage, a key input for any long-term SOL forecast. For example, ecosystem analyses in H1 2025 cite millions of active addresses and hundreds of millions of daily transactions during peak periods, reinforcing the thesis that throughput improvements are translating to real usage.

Finally, a potential regulatory unlock looms. U.S. market structure increasingly favors regulated products. CME’s intent to list Solana futures in 2025 and a formal SEC timeline for spot Solana ETF applications—culminating in an October 16, 2025, deadline—frame a path where tradable, compliant exposure could broaden access if approvals follow. This doesn’t guarantee higher prices, but it typically deepens liquidity and reduces friction for institutions.

Tokenomics and supply mechanics that influence price

Price is partly a function of supply and demand. Solana’s token supply and inflation schedule influence staking yields and circulating float. Public dashboards and exchange research outline Solana’s circulating and non-circulating supply, as well as an inflation schedule that decays over time. Understanding the dynamics of unlocks and the path of inflation helps investors estimate structural sell-pressure versus stakeholder-driven absorption. As of mid-2025, educational resources and tokenomics trackers provide granular breakdowns of circulating supply and planned unlocks, which investors can map against catalysts like network upgrades and ETF decisions.

On the demand side, staking is a sink for float. The staked Solana price prediction for 2025 aims to reduce the adequate liquid supply and align validator incentives with network health. If throughput upgrades and app growth increase fees and on-chain revenues, the economic flywheel for validators and liquid staking derivatives can grow in tandem. That said, macro risk can overpower tokenomics in the short run, so investors should treat supply models as a baseline, not a destiny.

Reliability and the “execution premium”

Solana has faced outages in prior years. While the frequency and duration have improved, the 2024 halt reminded the market that reliability is a moving target for high-performance chains. Firedancer and related client diversity are designed to reduce such risks. Investors should track the official Solana status page and independent outage timelines to gauge whether the network earns what we might call an “execution premium”: the market’s willingness to value speed and UX highly—so long as reliability stays strong. A durable fix to outages could compress risk premiums in SOL’s valuation.

Macro, regulation, and liquidity: the external gravity

Crypto prices don’t move in a vacuum. Liquidity cycles, interest-rate regimes, and regulatory clarity all matter. If U.S. products such as Solana futures trade with healthy open interest and if spot ETFs eventually gain approval after the October 2025 decision date, the investable surface for SOL broadens. Media and research coverage have lately focused on an “ETF trade” in altcoins. At the same time, this can be reflexive; it historically boosts awareness and lowers custody frictions for large allocators when approved. Conversely, delays or denials could defer inflows and amplify volatility.

Methodology for a grounded Solana price prediction

Rather than offer a single number, this forecast uses three scenarios—Base Case, Bull Case, and Bear Case—examining 2025 through 2031. Each considers:

-

Network execution: Firedancer rollout, client diversity, throughput, and uptime.

-

Adoption: active addresses, daily transactions, app categories like DeFi, DePIN, payments, and NFT markets.

-

Market structure: futures liquidity, potential spot ETFs, and institutional accessibility.

-

Tokenomics: inflation path, staking participation, and unlock dynamics.

-

Macro: crypto cycle phases, risk appetite, and regulatory developments.

The numbers below are illustrative ranges to frame expectations. They assume crypto cycles within the period and are not guaranteed.

Solana price prediction 2025

Base case (liquidity broadens, execution solidifies)

In the base case, CME futures have launched and trade actively, while ETF decisions remain pending into Q4 2025. Solana rolls out significant parts of Firedancer and adjacent performance upgrades, resulting in noticeable reliability gains. Active address and transaction trends remain strong relative to peers. Under these conditions, SOL could trade in a broad range centered around mid-cycle valuations, with upside tied to anticipation of ETF outcomes and continued app growth. The thesis relies on improved market infrastructure and consistent network execution.

Bull case (ETF optimism meets throughput step-change)

If sentiment builds into the October 2025 decision and performance upgrades land cleanly, a reflexive melt-up becomes possible. Historically, regulated access points can spur incremental demand. Combine that with narratives around Firedancer, enabling massive headroom, and you have conditions for multiple expansion. In this setup, higher valuations are plausible, though intrinsically fragile to any negative regulatory surprise.

Bear case (delays and risk-off)

A delay, denial, or technical hiccup could drag on SOL’s multiple. If macro tightens and risk assets wobble, high-beta coins typically underperform. Outage headlines or uneven client rollouts would reinforce caution, leading to valuation compression until the market regains confidence.

Solana price prediction 2026–2027

Base case (post-ETF normalization and app maturation)

Assuming an eventual ETF approval by late 2025 or 2026 and continued futures liquidity, the 2026–2027 period is focused on digestion and fundamentals. With a spot vehicle trading and custody simplified, allocators can size positions methodically. By now, Firedancer and related clients should be battle-tested, allowing Solana to maintain low fees and rapid finality even at higher loads. If daily active users and transactions stabilize at elevated levels, price action can reflect earnings-like intuition: investors reward chains that convert activity into fees and sustainable security budgets. The outcome is a steadier, though still volatile, appreciation profile relative to earlier hype cycles.

Bull case (category leadership plus new killer apps)

The upside scenario assumes Solana attracts breakout apps that reach tens of millions of mainstream users—think consumer payments, on-chain finance, and gaming that benefit from instant settlement and negligible fees. If network reliability holds and developer tools become even friendlier, Solana could capture a disproportionate share of DeFi TVL, NFT liquidity, and DePIN networks that monetize real-world activity. That flywheel would support premium valuations through 2027.

Bear case (competitive pressure and dilution)

If rival chains solve for speed and UX while retaining more mature ecosystems, Solana’s relative advantage could compress. Prolonged risk-off conditions or unexpected supply unlock dynamics could weigh on price. Investors should monitor tokenomics dashboards to anticipate unlocks and staking ratios in this period.

Solana price prediction 2028–2029

Base case (infrastructure commoditizes, brands matter)

By the late 2020s, base-layer performance may feel commoditized to users. What will matter is reliability, developer mindshare, and the presence of big consumer brands building directly on-chain. If Solana sustains a reputation for “it just works,” its valuation could increasingly track a blend of network cash-flow proxies (fees and MEV sharing if applicable), ecosystem breadth, and the appetite of regulated funds to hold SOL as a long-term bet on high-throughput smart-contract infrastructure. Network clients should be fully diversified by now, further reducing outage risk and supporting a lower risk premium.

Bull case (network effects consolidate)

In a strong outcome, the next wave of mainstream apps—payment rails, creator economies, and machine-to-machine micro-transactions—will standardize on Solana because it offers the best blend of speed, cost, and tooling. If that happens, the long-term outlook improves as apps themselves become distribution channels for SOL exposure and staking. Market structure would be deep, with ETFs, futures, options, and lending markets all robust.

Bear case (middleware captures the value)

It’s possible that more value accrues to cross-chain middleware, intent layers, or app-specific rollups, leaving base-layer tokens less reflexive to usage. If so, SOL could underperform despite healthy on-chain metrics, especially if token supply growth outpaces demand for staking and fees. In this case, investors should focus on fee capture, protocol revenue, and any design changes that align token value with usage.

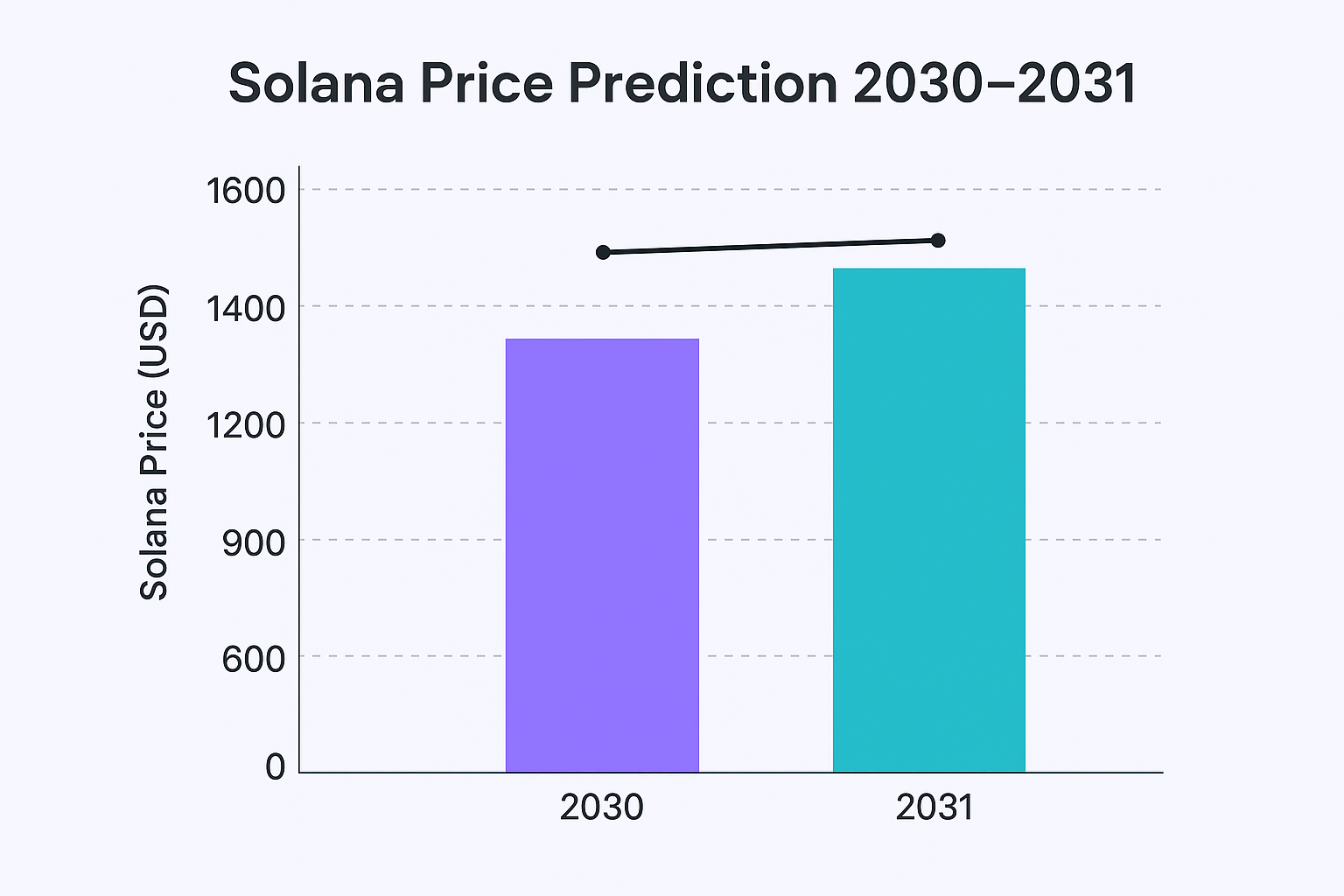

Solana price prediction 2030–2031

Base case (macro cycles and steady penetration)

Over a seven-year horizon, crypto tends to experience several mini-cycles. In the base path, Solana remains a top-tier chain, enjoys diversified client implementations, and continues onboarding mainstream users through wallets integrated into apps and devices. Liquidity is deep, institutions allocate via regulated vehicles, and staking is widely adopted. The price path is volatile but upward-sloping, mirroring broader digital-asset adoption curves.

Bull case (global settlement layer for consumer UX)

If Solana becomes the default settlement layer for consumer-grade crypto UX—cheap, instant, reliable—it could command a premium analogous to dominant platforms in traditional tech. At that point, price sensitivity shifts from tokenomics debates to network monetization and security budgets. Expansive throughput from Firedancer and future clients would keep fees low while enabling vast transaction volume, a combination that could sustain high valuations if value-accrual mechanisms favor the token.

Bear case (regulatory shocks or technological leapfrogging)

A harsh regulatory regime, a catastrophic exploit, or a superior technical architecture could erode Solana’s position. This scenario emphasizes diversification and risk management for long-horizon investors.

Key catalysts to watch

A handful of levers can change the slope of SOL’s trajectory between 2025 and 2031:

Firedancer mainnet milestones and client diversity. Concrete progress on performance and resilience is the most direct way to compress Solana’s risk premium and justify higher valuations. Independent reporting and ecosystem posts frame 2025 as the pivotal year.

Market-structure maturation. CME futures and a potential spot ETF open the door for hedging and compliant access, which generally supports liquidity and reduces volatility spikes. The SEC’s October 16, 2025, deadline is a clear waypoint for the market calendar.

Adoption metrics. Active addresses, transactions, and fee trends are leading indicators of real usage. Cross-checking multiple dashboards helps avoid single-source bias.

Reliability. Uptime and incident response will continue to shape investor confidence. Tracking the official status page and third-party incident logs provides an objective barometer.

Tokenomics. Supply growth, unlock schedules, and staking participation affect float and incentives. Dashboards that centralize these details are invaluable for anticipating supply-demand friction points.

Risks that could invalidate any prediction

The most significant risk is over-precision. Crypto narratives change quickly, and the most acute drawdowns often happen when consensus is strongest. Beyond that, watch for regulatory setbacks around ETF approvals. These macro shocks drain liquidity from risk assets, technical incidents that reduce network trust, and competition from chains that pair strong performance with massive developer grants or unique compliance features. Another under-appreciated risk is value capture moving away from base layers to appchains or cross-chain intent solvers, which could decouple chain usage from token value.

Putting it together: a realistic investor playbook.

A functional Solana price prediction is less about pinning a single number to a specific date and more about building probabilities around catalysts and risk factors. In 2025, liquidity plumbing and upgrade milestones dominate. In 2026–2027, the question becomes whether app usage and revenues scale sustainably within a more regulated market structure. In 2028–2031, the strategic debate shifts to where value accrues in the stack and whether Solana’s client diversity and developer gravity sustain a durable moat.

If you actively invest, align your thesis with trackable metrics: upgrade delivery against public goals, futures, and ETF progress; address transaction trends across multiple sources; and consider stakeholder penetration and fee evolution. Couple those with disciplined risk management, because even the strongest narratives face drawdowns.

Conclusion

Solana enters 2025 with clear strengths—speed, low fees, and a deep bench of builders—and a roadmap that aims to translate raw performance into durable reliability through Firedancer and multi-client diversity. Market-structure milestones such as CME futures and potential spot ETFs could broaden access and deepen liquidity, while usage metrics show meaningful traction in consumer-facing apps.

The flip side is well known: execution risk, regulatory uncertainty, and competition are real. Between 2025 and 2031, the most credible path for SOL is a volatile yet constructive climb, shaped by how well the network delivers reliability at scale and how much regulated access attracts new capital. Use the scenarios above as guardrails, revisit them as data changes, and size positions accordingly.

FAQs

Q: Will a Solana spot ETF approval immediately boost SOL’s price?

An approval could be a positive catalyst because it lowers friction for institutional investors and typically increases liquidity; however, markets often “price in” expected events. The SEC’s current timeline points to October 16, 2025, for key decisions, and outcomes can still vary. Monitor futures liquidity and flows after any launch to judge real impact rather than relying on headlines.

Q: What makes Firedancer such a big deal for Solana’s valuation?

Firedancer is a high-performance validator client intended to diversify Solana’s software stack and dramatically increase throughput and resilience. Multiple clients reduce correlated failures, while higher performance can support more applications without fee spikes, improving user experience and potentially investor confidence. Public materials emphasize 2025 as a key milestone year.

Q: How should I weigh Solana’s past outages when considering the long-term outlook?

Past incidents are relevant because they shape reliability perceptions and risk premia. Official status dashboards and independent timelines show the history; the roadmap’s answer is client diversity and architectural hardening. If outages stay rare and short, the market may grant Solana an “execution premium.” If not, multiples can compress.

Q: Which on-chain metrics matter most for SOL over the next cycle?

Focus on daily and monthly active addresses, transactions per day, fee trends, and the breadth of top apps across DeFi, NFTs, payments, and DePIN. Use multiple analytics sources to validate direction and avoid single-provider bias. Pair this with tokenomics trackers for circulating supply, unlocks, and staking participation.

Q: Could macro headwinds overwhelm otherwise strong Solana fundamentals?

Yes. Tight liquidity, rising real rates, or broad risk-off sentiment can dominate token-specific progress in the short run. That’s why scenario analysis and position sizing are as crucial as technology milestones or adoption metrics. Even with futures and ETFs improving access, external gravity still moves crypto markets.

Also Read: 3 Explosive Altcoins Set to Skyrocket in 2025