In the fast-moving world of stock markets, few names command as much attention as Meta Platforms, Inc. Whether you’re an investor, trader, or casual observer of Big Tech, staying informed about the Meta stock price today is essential. This is more than just a number—it reflects investor sentiment, company performance, broader tech trends, and macroeconomic conditions. In this article, we delve into the current Meta stock price, examine the factors that drive its movement, and outline key considerations for the future.

Meta Stock Price Today: Live Snapshot

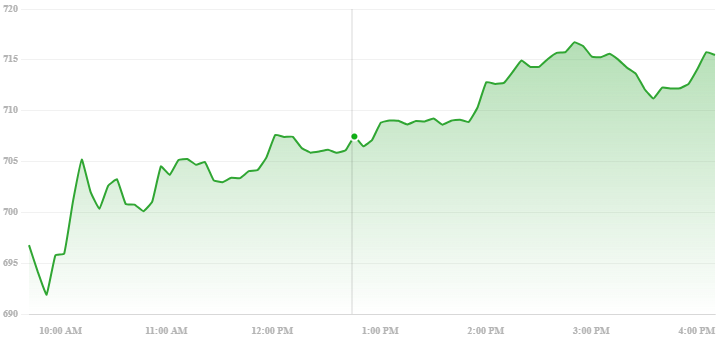

As of now, the Meta stock price today is approximately USD 715.66, reflecting a modest intraday gain of around +5.19 (0.73%). The stock opened near USD 704.81, with a trading range between USD 690.66 and USD 716.82 during the session.

Across major financial platforms, you’ll find slight variations in quoted values due to timing, real-time data feeds, and market delays. For example, on Google Finance, the Meta share price is listed at USD 715.66 with after-hours quotes showing minor fluctuation. MarketWatch also tracks intraday movement and historical quotes for comparison.

In addition to the raw price, key metrics often accompany the quote, such as the P/E ratio, EPS (earnings per share), market capitalisation, and 52-week high/low. These help contextualise whether Meta Platforms’ stock is overvalued, undervalued, or trading on fair fundamentals at a given moment.

What Drives Meta’s Stock Price?

Business Fundamentals & Earnings

At the core, Meta’s stock valuation is tethered to its business performance. Meta generates the bulk of its revenue from digital advertising across Facebook, Instagram, and other platforms, with emerging contributions from AI, augmented reality, and the metaverse. When Meta reports earnings that exceed expectations (or disappoint), the Meta stock price today can move sharply in response.

For instance, in Q2 2025, Meta delivered strong results with revenue beating consensus, which helped send investor optimism higher. Capital expenditures remain high, given investments in AI and infrastructure, which amplify both the upside and downside risks.

AI, Innovation & Strategic Progress

Meta’s aggressive pivot toward artificial intelligence, along with its investments in tools like Llama and internal AI chips, plays a significant role in shaping market expectations. Analysts often reward or penalise the stock based on whether Meta’s innovations are believed to yield long-term competitive moats.

Beyond AI, partnerships and deals—such as Meta’s $14.2 billion contract with CoreWeave for cloud and computing infrastructure—inject both immediate attention and long-range implications for Meta’s valuation.

Macro and Market Sentiment

Even the strongest companies are not immune to macroeconomic conditions. Rising interest rates, inflation, geopolitical risks, and broader tech sector rotations are exerting a significant influence on the Meta stock price today. For example, when tech stocks pull back, Meta often follows as part of the broader sector correction.

Moreover, regulatory pressures—particularly in Europe and around issues such as antitrust, data privacy, or content moderation—can create uncertainty and negatively impact stock performance. In fact, Europe’s legal scrutiny has been flagged as a potential headwind for Meta.

Technicals & Support/Resistance

Traders also closely watch technical analysis levels—such as support around USD 716–720 and resistance nearer USD 748–775—which can guide short-term price movements. Breaks below or above these levels tend to trigger momentum from both algorithmic and discretionary traders.

Short-term interest, volume, and momentum indicators, such as RSI or MACD, also influence expectations. If a strong support level holds (or fails), it can influence buying or selling pressure around the Meta share price.

Recent Trends and Patterns in Meta Stock

How to Monitor Meta Stock Price Today Effectively

To track the Meta stock price today with precision, start by using real-time market platforms such as Nasdaq, Yahoo Finance, Google Finance, and MarketWatch. These platforms deliver live quotes, interactive charts, and up-to-date financial metrics—allowing you to watch intraday movement as it unfolds.

Since news and catalysts can instantly affect Meta’s price—be it regulatory announcements, earnings surprises, or AI-related developments—you should set up alerts or follow trusted financial news outlets so you can react promptly to sudden shifts. At the same time, observe technical levels: watch for support and resistance zones, analyse volume trends, and apply momentum indicators or moving averages to assess whether the current price action is sustainable or weakening.

Another helpful strategy is to compare Meta’s performance with that of its peers, such as Alphabet, Apple, Microsoft, or Nvidia, because divergence or relative strength within the tech sector can indicate rotation or sector trends. By combining live data, news monitoring, technical analysis, and peer benchmarking, you’ll gain a fuller and more responsive picture of how the Meta share price is evolving throughout the trading day.

Risks & Catalysts That Could Shift Today’s Meta Stock Price

Regulatory & Legal Action

One of the most significant threats to Meta’s stock valuation stems from regulatory and legal pressure, particularly in Europe. Enforcement actions, antitrust lawsuits, or stringent data privacy rulings—such as fines tied to violations of GDPR or new EU digital laws—can significantly dampen sentiment. In particular, Meta faces potential penalties equivalent to a percentage of global revenue if non-compliance is found, making the risk material even if no cash flows are immediately affected.

Execution Risk on AI & Innovation Strategy

Meta’s bold pivot into artificial intelligence and metaverse investments is capital-intensive and complex. If its execution lags—if machine learning models underperform, or infrastructural costs erode margins—investors may penalise its growth multiple. The company has restructured its AI divisions and committed massive capital, but such moves carry the risk of overreach or strategic dislocation.

Ad Revenue Cycles & Broader Economic Conditions

Since Meta’s core business remains advertising-driven, cyclical shifts in ad spend often have an outsized influence. In a slowing economy or during budget cuts, advertisers may pull back, reducing Meta’s top line and putting pressure on margins. Global macro weakness, shifts in consumer demand, or contraction in key markets can all translate into revenue compression.

Macroe Headwinds & Market Sentiment

Wider economic forces—such as rising interest rates, inflationary pressures, currency fluctuations, or geopolitical instability—can alter risk premiums and investor sentiment across tech stocks. For Meta, which has a global footprint, currency swings or shifting capital flows can exacerbate volatility. A risk-off environment tends to punish high-multiple growth names like Meta, even without company-specific news.

Unexpected Surprises & Market Reactions

Even in the absence of structural issues, surprising developments—such as an earnings miss, downward guidance from the CFO, unexpected Mergers and acquisitions (M&A) deals, or large insider transactions—often trigger sharp market reactions. Because Meta is watched closely, surprises tend to be amplified, particularly in thinner after-hours or premarket trading. These events can quickly affect the Meta stock price today, sometimes in leaps rather than gradual moves.

Conclusion

The Meta stock price today sits at a dynamic intersection of fundamentals, innovation, sentiment, and technical structure. At roughly USD 715.66, Meta’s stock reflects strong confidence in its core business as well as ambitious bets on AI and infrastructure growth. Yet it is not without risk—regulatory threats, macro uncertainty, and execution challenges all contribute to volatility.

For those tracking Meta’s share price, consistent monitoring using real-time platforms, staying abreast of catalysts, and understanding technical levels will help parse meaningful movements. Whether you’re a long-term investor or short-term trader, Meta remains one of the most compelling stories in the Big Tech universe.

FAQs

Q: What is the current Meta stock price today in real time?

As of now, the stock is quoted at approximately USD 715.66, with intraday movement between USD 690.66 and USD 716.82.

Q: How often does the Meta share price update?

Real-time platforms update nearly continuously during market hours (with slight delays). After-hours or premarket trading may also reflect adjusted quotes.

Q: What factors could cause a sudden drop in Meta’s price?

Regulatory actions, disappointing earnings, macro volatility, or missteps in AI strategy are common catalysts for sudden drawdowns.

Q: Are analysts bullish on Meta’s future price?

Yes—many forecasts point to USD 800–900 or higher targets over 12 months, though assumptions vary on growth and margin stability.

Q: How can I track Meta stock price movements efficiently?

Use platforms like Nasdaq, Yahoo Finance, and MarketWatch for real-time quotes, pair them with news alerts, and monitor support/resistance zones for actionable context.

See More: Cardano News Today: Q4’s Top Trending Cryptos